Welcome to our blog, where we delve into a topic that affects us all: taxes. In our latest YouTube video, titled “,” we aim to demystify the often perplexing world of taxation in the United Kingdom. Whether you’re a newcomer navigating the complexities of the tax system or a long-time resident seeking clarity,this video provides insightful guidance tailored to the Malayalam-speaking community.

While the video begins with a warm thank you and a promise to see you in the next installment, the content we explore together is crucial for making informed financial decisions.From income tax and National Insurance contributions to the nuances of self-assessment and allowable expenses,we’ll break down essential concepts in a straightforward manner.join us as we unpack the key topics that will empower you to approach your taxes with confidence and understanding. Let’s dive into the essentials of UK taxes and uncover the information that shapes your financial landscape!

Table of Contents

- Key Aspects of the UK Tax System Explained

- Navigating Income Tax: Essential Insights and Tips

- Understanding VAT and Its Impact on Daily Life

- Practical Recommendations for Effective Tax Planning

- Q&A

- The Way Forward

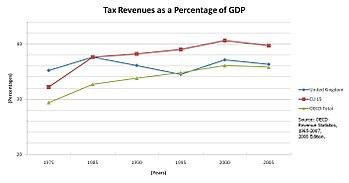

Key Aspects of the UK Tax System Explained

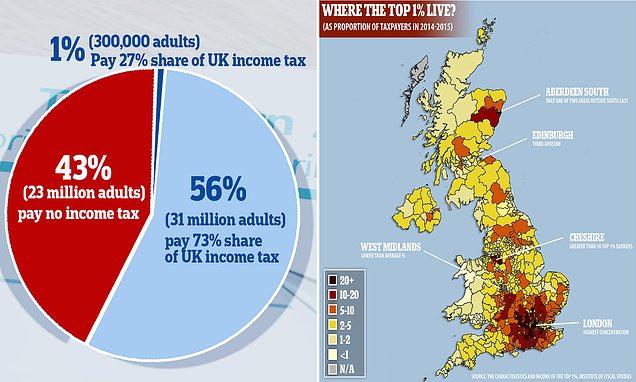

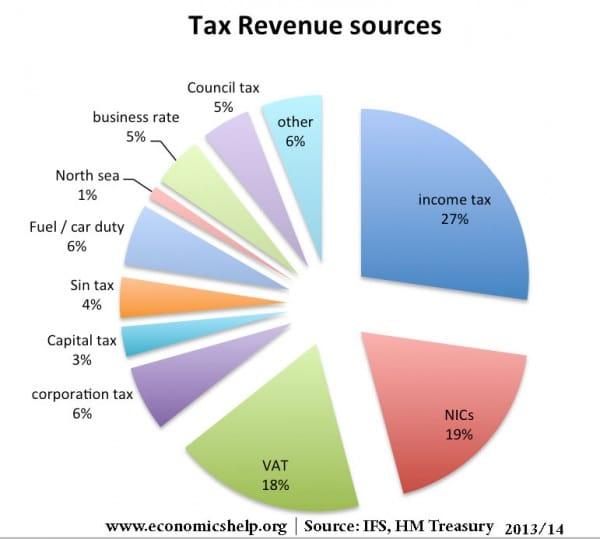

The UK tax system is multifaceted, encompassing various types of taxes that individuals and businesses are required to pay. Income Tax is one of the most significant components, levied on earnings from employment, self-employment, and other income sources. Residents are allowed a tax-free personal allowance, which varies depending on age and income. beyond income tax, individuals may encounter National Insurance contributions, essential for funding state benefits, health services, and pensions. Additionally, Value Added Tax (VAT) applies to goods and services, impacting everyday purchases and business operations alike.

Businesses also face a range of taxes that can effect their operations. Corporation Tax is charged on profits made by limited companies, while Business Rates are applicable to most non-domestic properties.Tax compliance is further enriched by various reliefs and exemptions that help small businesses thrive. Here’s a brief overview of relevant tax categories:

| Tax Type | Who Pays? | Key Points |

|---|---|---|

| Income Tax | Individuals | Based on earnings; includes personal allowance. |

| National Insurance | Employees and Employers | Contributions fund social security benefits. |

| Corporation Tax | Businesses | Tax on company profits. |

| Value Added Tax (VAT) | Consumers and Businesses | Charged on most goods and services. |

Navigating Income Tax: Essential Insights and Tips

Understanding UK taxes is crucial for ensuring compliance and optimizing your financial situation. When navigating the tax landscape, consider the following essential tips:

- Keep detailed records: maintain organized documentation of your income, expenses, and any tax-deductible items.

- No your deadlines: Familiarize yourself with tax return dates and payment deadlines to avoid penalties.

- Understand your allowances: Maximize your tax-free allowances and reliefs to minimize your taxable income.

- Seek professional advice: Consider consulting with a tax advisor, especially if your situation is complex.

Additionally, it’s beneficial to stay updated with changes in tax laws and regulations. Being proactive can help you make informed decisions about your finances. Here’s a swift table summarizing key tax components:

| Tax Component | Current Rate |

|---|---|

| Income Tax | 20% (Basic rate) |

| Capital Gains Tax | 10% (Basic Rate taxpayers) |

| VAT | 20% |

Understanding VAT and Its Impact on Daily Life

Value Added Tax (VAT) plays a significant role in shaping the economy and influencing everyday purchases in the UK.When consumers buy goods or services, they frequently enough encounter this indirect tax included in the price. Understanding how VAT operates is crucial as it affects:

- Retail prices: Businesses typically incorporate VAT into the cost of their products, which may lead to higher retail prices compared to regions without such a tax.

- Budgeting: Awareness of VAT can aid individuals in budgeting and financial planning, helping to account for these additional costs.

- Consumer Choices: It may influence decisions on where to shop or what to purchase based on how VAT is applied across different sectors.

From a broader perspective, VAT revenues contribute to government funding, which helps finance public services like healthcare and education. The submission of VAT varies across categories, with some essential goods having reduced or zero rates. This tiered approach creates an interesting dynamic in spending behavior. here’s a simple overview of common VAT rates:

| Product/Service Type | VAT Rate |

|---|---|

| Standard Goods | 20% |

| Reduced Rate Goods (e.g., some food items) | 5% |

| Zero Rate Goods (e.g., children’s clothing) | 0% |

Practical Recommendations for Effective tax Planning

Tax planning is essential for individuals and businesses alike, ensuring that you make the most of your finances while complying with legal obligations. To maximize your tax efficiency, consider the following practical strategies:

- Utilize Allowances: Be aware of your annual tax-free allowances, such as the personal allowance and capital gains tax exemption.

- Invest Wisely: Explore tax-efficient investment vehicles like ISAs and pensions, which can provide significant tax benefits in the long run.

- Keep Accurate Records: maintain organized documentation of your earnings, expenses, and any allowances or reliefs applied.

- Consult a Professional: Seek advice from a qualified tax adviser or accountant to navigate complex regulations and identify tailored strategies.

Adopting these strategies can greatly enhance your tax position.Additionally, it’s prudent to regularly review your financial situation to take advantage of any new tax laws or reliefs available. Remember to stay informed about your responsibilities:

| Action | Frequency |

|---|---|

| Review Tax Band Updates | Annually |

| Update Financial Records | Monthly |

| Consult a Tax Professional | Quarterly |

Q&A

Q&A: Understanding UK Taxes – A Quick Guide in Malayalam

Q1: What is the main focus of the video “”?

A1: The video aims to provide viewers with a foundational understanding of the UK tax system, tailored specifically for the Malayalam-speaking audience. While the transcript itself is quite brief,we can infer that the video likely touches upon various tax types,their purposes,and how they impact individuals living in the UK.

Q2: Who is the intended audience for this video?

A2: The intended audience seems to be Malayalam speakers, notably those who are living in or moving to the UK. This may include immigrants, students, and professionals looking to understand their tax obligations in a new country.

Q3: What topics might have been covered in the video, based on its title?

A3: Even though the transcript doesn’t detail specific content, the title suggests coverage of key topics such as:

- Types of taxes in the UK (Income tax, National Insurance, VAT, etc.)

- How tax brackets work

- The process of filing taxes

- Tax relief and credits

- Important deadlines and how to get help if needed

Q4: Why is it important for newcomers to understand the UK tax system?

A4: Understanding the UK tax system is crucial for newcomers to ensure compliance with the law, avoid penalties, and effectively manage personal finances. It helps individuals budget properly and take advantage of any tax reliefs applicable to their situation, which can make a significant difference in their financial well-being.

Q5: Were there any resources or links provided in the video for further information?

A5: The transcript does not specify any resources, but it’s common for educational videos to include helpful links in the description. Viewers are encouraged to check the video description for additional resources,such as official government websites or tax consultancy contacts.

Q6: Can viewers expect follow-up videos on this topic?

A6: While the transcript concludes with a simple farewell, the creators might have plans for follow-up content. Those interested in further details are encouraged to subscribe to the channel for updates and future videos that delve deeper into specific aspects of UK taxes.

Q7: How can viewers apply what they learned from the video?

A7: viewers can start by assessing their own tax situation in relation to the insights shared in the video. They should keep track of their earnings, learn about their eligibility for different taxes and contributions, and stay informed about any changes in tax laws that may affect them.

Q8: What should a viewer do if they have more questions about taxes?

A8: If viewers have more questions after watching the video, they can consider seeking professional advice from tax consultants, attending tax workshops, or joining online forums where they can interact with others facing similar issues. Additionally, the UK government’s official website can be a great resource for accurate and extensive tax information.

Feel free to explore the video for a deeper understanding of this essential topic!

The Way Forward

As we wrap up our exploration of the insightful YouTube video, “,” it’s clear that demystifying the complexities of taxation can empower individuals in making informed financial decisions. We delved into important topics such as income tax, National Insurance, and the various brackets that affect how much we contribute to the system. By breaking down these concepts in an accessible way, the video serves as an invaluable resource for the Malayalam-speaking community navigating the UK tax landscape.

As you continue your journey toward financial literacy, remember that understanding your taxes is not just about compliance; it’s about reclaiming control over your financial future. Whether you’re a student,an expatriate,or a long-term resident,having a grasp on these principles can substantially ease the tax season’s stresses.

Thank you for joining us on this informative dive into UK taxes. Don’t hesitate to share your thoughts or questions in the comments below, and make sure to check out the original video for a more in-depth look. Until next time, stay curious and keep learning!